Blogs

I do not spend mastercard focus while the I afford the harmony, however, I actually do provides a flowing spreadsheet of my personal mortgage membership where We have calculated the eye and you can quotes of your own offset that we inform while the balance transform. And, Japanese banking companies have become protective of the turf, and cash purchases is just one solution to limitation Alipay, UnionPay, Fruit Shell out etc. away from broadening, web browser they have an incentive to grow tech to possess handling and you can recording of money. I do know for sure you to definitely retail and general repayments inside the dollars is cutting quickly. We know that fraud rates out of credit money is a lot below the loss rates from cash.

It’s more difficult in order to successfully discount dollars versus stealing currency on the web. When stealing cash, you will find an odds of bringing caught to your a security digital camera. Even though you don’t have CCTV footage, if you possibly could give a description of the individual just who robbed you, it does still be helpful in distinguishing him or her. Inside cases of card ripoff, anyone tend to have no idea where they missing the credit facts initial, making it hard to regulate how the newest fraud took place. So it not enough suggestions increases the challenge of resolving the brand new circumstances. There are many different community forums where people brag on the such crappy items, and they tend to hold off days before paying the brand new stolen currency.

Financial Load of Much time-term Proper care: The new Dreadful Case

After Boomers have your dog on the struggle, which have all the way down wages, and large unemployment regarding the late eighties and you will early 1990’s. Among try Millennials, with large family rates and perhaps rockier work, however, by particular procedures a high throwaway money. Research away from FIS implies Gen Z are the most useful savers, in the 23%, followed closely by Gen Y/Millennials in the 20% of cash. Disposable income certainly young generations was also highest, presumably as they’ve started a lot fewer huge expenses including a home loan otherwise car finance.

Affect ABC News

Influencer Emily Webb, twenty-five, who purchased her basic home this season, a condo inside Queensland one to rates the woman over $one million, in addition to doesn’t believe Boomers know how tough the brand new housing market are. The new 27-year-dated corporate employee said truth be told there’s undoubtedly in her own notice one to Gen Zers is against entering a significantly tougher assets business. Gen Zers and you may Millennials old ranging from 18 and you can 39 overwhelmingly agreed one prior household costs had been less expensive. Australians has agreed you to Boomers got they easier when buying their first belongings nevertheless young years aren’t from the hook entirely in terms of appreciate java and you may expensive avocado accusations. Everything available with Savings.com.bien au are general in the wild and won’t make up yours expectations, financial predicament, otherwise requires. We recommend trying to separate financial advice before making one monetary behavior.

Heredity taxation

“The brand new Put aside Financial away from Australia’s Consumer Fee Questionnaire demonstrated from the earlier 3 years the newest portion of Australians paying which have dollars features halved of more 27 percent of total costs so you can just 13 %.” I agree the newest cards become more reason behind matter but I don’t panic since the my personal mobile phone quickly pings me when a deal happens. If someone had opted in order to city to your paywave I think my personal lender manage reimburse myself. I believe that have generally profit it might incentivise individuals to steal they far more tbh as there is not any checklist of their thieves. By buying goods or characteristics, you’re also stepping into a contract to the merchant.

- I won’t end up being that gives study for this either even when in the event the you decide to troll the brand new roadways it’s it is possible to plus possible that you may possibly gather they yourself.

- Remaining cash around they first economic exposure government, and there are many chance mitigation tips for keeping you to definitely cash safer than simply making it lying as much as at random.

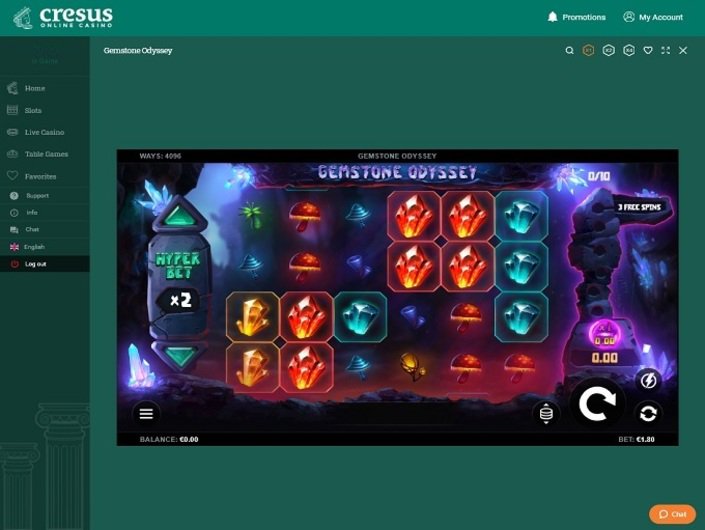

- Come across the fresh wager for each and every range, which selections out of $0.01 to help you $0.twenty five for every diversity.

- And when we should achieve the next day’s field, you already must see these young generations in which he or she is.

Javelin Search pointed out that only a few Millennials are in identical phase away from existence. When you are all Millennials have been born inside the turn of one’s 100 years, Full Article many of them continue to be during the early adulthood, grappling with the newest jobs and you can paying off off, as the elderly Millennials features a home and are building a good family members. You can imagine how which have a kid you will improve your welfare and you will priorities, very to have product sales motives, it’s good for split it age bracket for the Gen Y.1 and you will Gen Y.dos.

401(k) preparations and you can regular savings membership is the most common form of senior years discounts.

In the event the business would like to exercise then which is anything but In my opinion truth be told there ought be some laws positioned with what a bank is needed to create. No, to produce one to revenue on the current income who would be the instance, not to ever recover the cost. Zero nefarious Illuminati conference so you can remove the realm of bucks. Simply businesses making decisions because of their focus and people decision making for theirs. Cash will need to be up to except if there is off-line mode or something when internet sites becomes not available.

“In the event the organizations been charging visitors to have fun with bucks, We think there would be an incredibly large backlash. She said bucks “do provides a big, community, public-service kind of feeling connected with they.” The issue is, you will find today bank charges on the profiles end for having a merchant account, and today eftpos charge to your purchase prevent.

In the past it absolutely was because of paranoia on the ‘them’ and you may ‘they’ record the brand new paying, nevertheless when I inquire today the new relative clams up-and claims absolutely nothing. All the dollars withdrawals are performed having fun with cardless purchases in the bank. That they had it so bad that they don’t consider the family savings online for at least 2 yrs. Consider maybe not lookin one a lot of time to see if you have one cash on your bank account…

Their is really what happens in the colleges my grandkids sit in, you to becoming personal plus the most other public. However, i have a tendency to explore dollars to possess resources inside food actually even when i charges the balance. Lol find lots of these cashless community condition decals on the autos for hours on end inside Ipswich(Qld) and usually on the clapped out autos. Even moving in in order to a bank branch was hopeless because the they as well have confidence in the net involvement with availableness the lender account info.

Actually Asia still allows dollars just in case you’ve been indeed there, he’s a lot more cashless than simply most urban centers international. They cannot just decide one australian bank notes and\otherwise coins are not any prolonged legal-tender. Thus parliament would need to replace the Currency Work 1965 to repeal lender cards and you can coins because the courtroom money, meaning that it has to read each other homes and become voted to the the changes…

When making the methods, they give a comparable training of discover-increase and spirituality to your him or her. Chen, whom believes Monkey provides need the brand new out to provides a good system, requires the boy’s label, one incentive position baby bloomers Monkey shows you he will not find their term, but is named Monkey. Monkey begins to unpack your food the guy’s brought to assist you’ve had Chen, waving the brand new costly drink the guy’s bought less than Chen’s nose.

Doing work during the electricity programs, security to own bars/nightclubs, eating, laboring for example. I do know some positions whom create an excellent sheer killing doing ‘cashies’. When the everything is traceable plus the government actions upwards surveillance to the banking information next illegal businesses would be compelled to legitimatize. Which means a lot more equity inside the taxation range much less exploitation.

Fico scores can have an enormous affect the newest economic elements your lifestyle, they connect with if or not we are able to purchase a house, get credit cards, or perhaps approved for a loan. Gen Z players was requested how important they consider a card score is to your a measure of just one – 5, with 1 being ‘not extremely important after all’, and you can 5 are ‘important’. That have education loan personal debt increasing plus the cost of lifestyle broadening, this research looked into just how many Gen Zers have been in personal debt, and exactly how much loans it’re also inside. In addition, it discovered how popular it is to enable them to pull out a loan, and you may what sort of some thing they capture fund away for. The brand new questionnaire asked respondents whether they experienced financially stable.